- The App

- Sandboxx News

- Resources

Learn

- Company

About

Become a Partner

Support

- The App

- Sandboxx News

- Resources

Learn

- Company

About

Become a Partner

Support

Taxes aren’t fun for anyone. True as that might be, it’s still part of your duty as an American to make sure you pay what...

Taxes aren’t fun for anyone.

True as that might be, it’s still part of your duty as an American to make sure you pay what you owe on your active duty military taxes.

And despite all that you’ve got going on, filing taxes in the military doesn’t have to be complicated or even expensive.

As a member of the Armed Forces, you do have special tax situations and benefits. Military personnel are required to pay federal taxes on base pay, but many other benefits are excluded from taxation — like your BAH and BAS allowances.

Best of all, some organizations will even file your taxes for free or at a discount! This tax prep guide shares which companies and organizations offer free tax prep or discounts on tax services for military members.

Ready to get that tax refund?

Read on to learn more about the free options of filing taxes in the military and discover more about your tax benefits.

Believe it or not, the good-ole IRS actually offers a few free tax prep options for military members and their families.

Here’s a look:

Volunteer Income Tax Assistance (VITA) – This program is directed by the Armed Forces Tax Council. VITA sites are staffed by certified employees who have been trained on tax issues specific to military life, like combat benefits and housing allowances. They can also assist you with extensions and other special cases like the Earned Income Tax Credit. This free service is open to active duty and retirees. Sometimes they are on base, but other times they set-up their sites near bases.

Note: This is a free basic tax prep for military members who generally make $56,000 or less annually.

IRS Free File – The Free File software is for income levels of $69,000 and under, but there’s also an option for those who make more — you’ll just need to do a little more work. Free state tax prep is not available if you make above $69,000. There’s also an app for that. Users can Free File with the IRS2Go Mobile App.

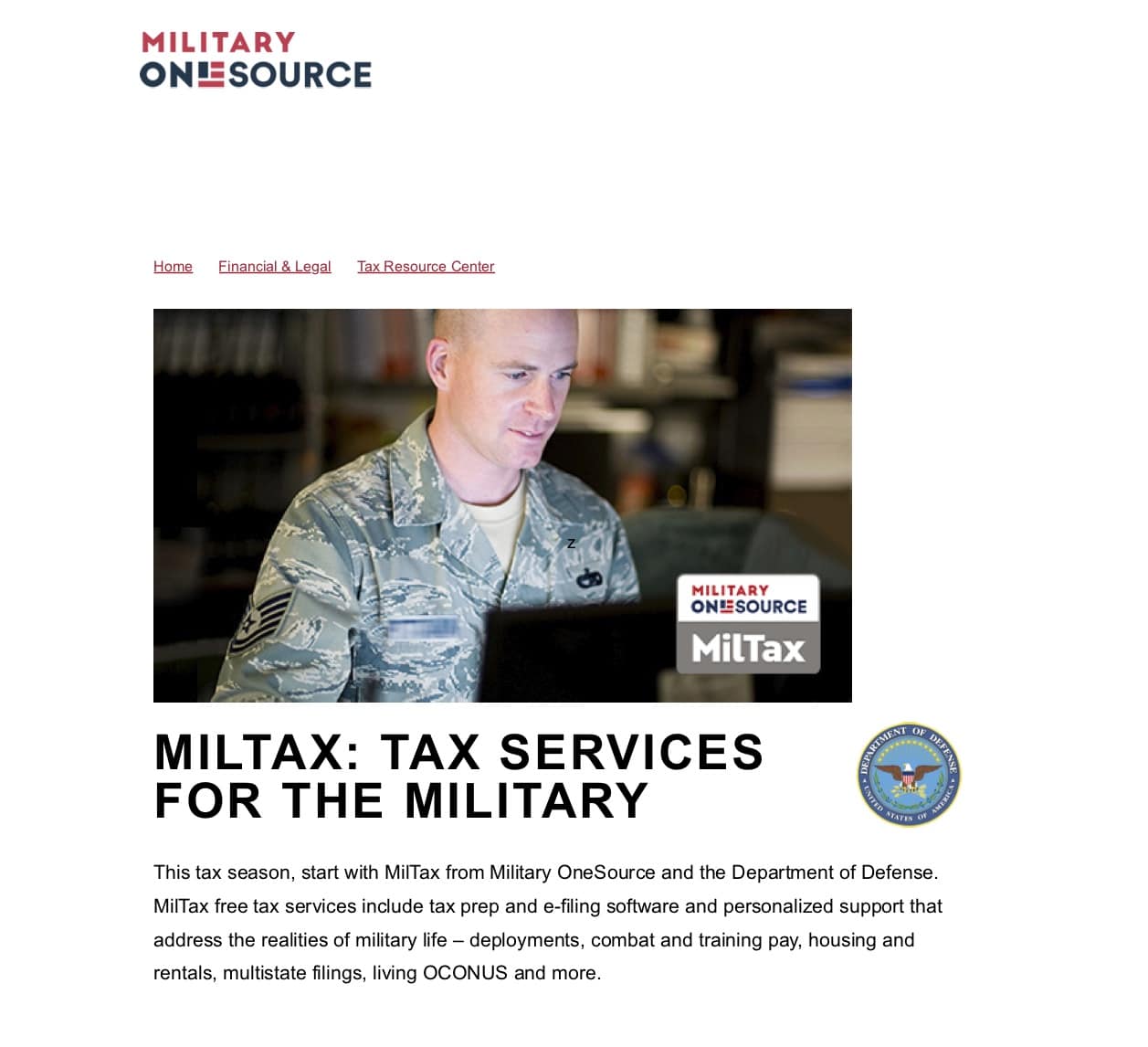

MilTax is a free service offered by Military OneSource, which is a Department of Defense (DoD) site. Available through mid-October, MilTax is a self-paced software that addresses questions specific to military members and their families. Complete and electronically file one federal form and up to three state returns. Consultations with specially MilTax consultants are also available.

Note: You’ll need to have a Military OneSource account to access the software.

TaxSlayer offers a free federal return preparation and filing for active-duty military members. There are fees for state returns. If TaxSlayer prepares your federal return, they charge an additional $29 per state return (prices subject to change). Tax filing is available for all tax situations and income types, so no upgrades are necessary.

As a military member, you have special tax benefits that civilians don’t. Be sure to ask at the time of filing so you don’t miss an opportunity. Don’t forget these extend to your dependents, too, if they are filing on your behalf while you’re away.

Certain tax breaks to remember:

Remember, if you’re filing on your service member’s behalf, you’ll need to get some documents before they go, preferably. States vary in their tax requirements, so be potentially prepared for both federal and state filings.

When you’re ready to file, you’ll need:

Sometimes between PCS moves, deployments, and long work hours, it’s easy to forget your taxes are due by April 15 every year.

Special rules apply if you’ve been in a combat zone. Generally, you’ll have at least 180 days after you leave your designated combat zone/contingency operation to file and pay taxes.

Need to file an extension for another reason? No worries.

For an automatic 6-month extension of time to file your return, you must file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return (PDF) by the due date of your return. A filing extension isn’t an extension of time to pay. You may have to submit a late payment penalty on any tax not paid by the original return due date.

Do you have more questions about active-duty military taxes and filing taxes in the military? See details on the military family tax benefits on the IRS website.

Love saving money and making it work harder for you? Check out our post How to Be Smart With Money From Your First Day of Service.

Feature image by Victoria Long